In this tutorial, we’ll explore the FX Magnetic Daily Compass, a powerful trading tool designed to simplify daily market trend forecasting. This guide will help you understand how to effectively use the indicator to make more informed trading decisions and simplify trend reading.

Before You Start

You will need:

- MetaTrader 4 platform

- FX Magnetic Daily Compass indicator

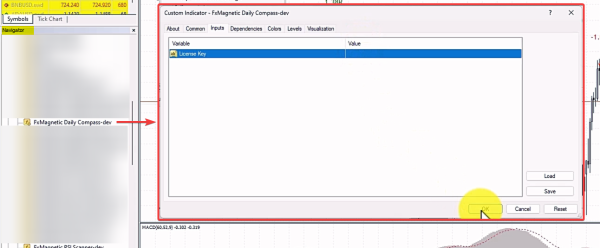

- Your unique license key

- Basic understanding of trading principles

Tip: Check our How to Install FX Magnetic Software tutorial for detailed installation instructions.

What is FxMagnetic™ Daily Compass Indicator

FxMagnetic Daily Compass indicator analyzes daily candles and calculates probabilities to forecast whether today’s market is likely to move up or down. It helps traders align their strategies with the market’s potential direction.

It’s like checking the weather forecast before heading out—just as you decide what to wear based on the predicted weather, you can decide your trades based on the Daily Compass forecast.

Key Benefits

Understanding the Daily Compass Indicator

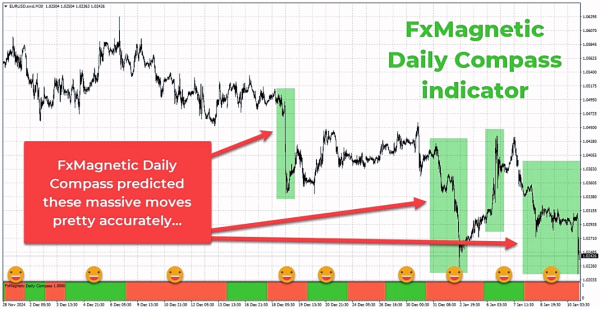

The Daily Compass uses color coded forecasting system:

- Green Candle: Potential uptrend.

- Red Candle: Potential downtrend.

How It Works

- Daily Trend Identification

- Predicts market direction at the start of each trading day.

- Color of the first candle (after midnight) determines the day’s potential trend.

- Trend color remains consistent throughout the day.

- How To Use

- Prioritize BUY trades when you see green.

- Prioritize SELL trades when you see red.

Implementing the Daily Compass Strategy

A. Standalone Usage

- Pre-Trade Routine

- Initially check your trading strategy to determine your market trend bias.

- Use Daily Compass for added confluence

- See if your trading strategy aligns with the compass

- Filter out contradictory signals

- Practice risk and money management

- Trading Discipline

- Focus on trades aligned with the Daily Compass signal. (See How To Use)

- Ignore signals that do not confluence.

- For counter trend test trades, implement stricter risk and money management to preserve your capital.

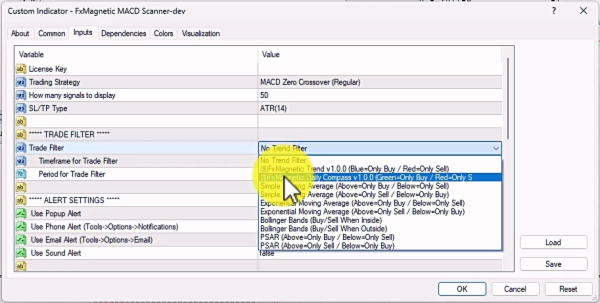

B. Integration with FxMagnetic Trading Scanners

- Scanner Configuration

- Compatible with multiple scanners:

- MACD Scanner

- RSI Scanner

- BB Scanner

- Requires separate license

- Easily configurable in indicator settings

- Compatible with multiple scanners:

- Trade Filtering

- Eliminates mixed trading signals

- Reduces emotional trading

- Encourages disciplined approach

If you have the Daily Compass and any of the FxMagnetic Scanner installed, and have a license on both, you can select the Daily Compass inside the scanner’s Trade Filter inputs.

You can learn more about trade filters in our How to Use Trade Filters with FxMagnetic tutorial.

Tips For Success

-

- The Daily Compass is NOT a holy grail. Understand that no single indicator guarantees success. Accept that losing trades are part of the trading journey. Better focus on long-term performance rather than individual trade outcomes.

- Always view the Daily Compass as a complementary tool. Use it as added confluence to your existing trading strategy. Never make trading decisions solely based on the indicator.

- Again, never risk more than you can comfortably afford to lose. Always use stop-loss orders and maintain risk and money management.

- Regularly review and analyze your trading performance. Dedicate time in reviewing your stats periodically. Your numbers won’t lie. It will tell you how you can adapt and what you need to adjust with your approach. It will tell you what is working and what is not.

- Maintain emotional discipline. Do not let emotions drive your trading decisions. Stick to your predefined trading plan to avoid over trading. Focus on consistency.

- Remember: Trading involves inherent risks. No single indicator can predict market movements with absolute certainty. Success comes from a disciplined, well-researched, and adaptable approach to trading.

- Test, validate, and prove before trading live. Backtest your strategy on historical data, validate its performance through forward testing on a demo account, and only then consider live trading. No single indicator can rescue a fundamentally weak trading system.