In this tutorial, we will walk you through the process of discovering winning trading strategies with FX Magnetic BB Trader.

You’ll learn essential setup steps, from platform configuration to historical data preparation, and understand how to use optimization to find profitable trading setups.

The guide breaks down the process into manageable steps: software setup, strategy building using Bollinger Bands parameters, optimization techniques, and auto trader implementation. We’ll also cover crucial aspects of strategy monitoring and portfolio management to help you stay on track.

This guide is designed to help both new and experienced FX Magnetic users effectively utilize BB Trader’s features.

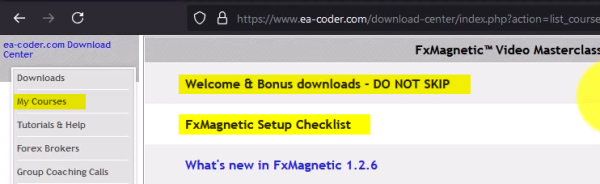

Initial Setup Checklist

Before beginning any strategy development, access the setup checklist from the download center in your course access section. This document guides the entire setup and optimization process.

To Access Download Center:

- Log into your account

- Click Access Course

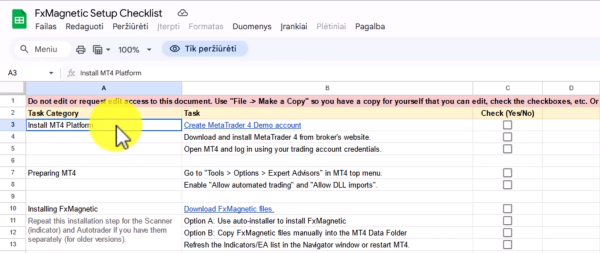

- Locate Setup Checklist document.

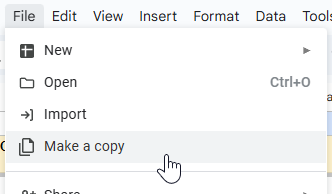

- Upon opening the document, click File > Make A Copy

- Save the copy in your own Google Drive.

- Use this checklist as your guide as you progress

Downloading And Installing FxMagnetic Software

The installation process for any FxMagnetic Software (i.e: Candlestick, RSI, BB, etc.) is similar. You can read more about it here.

Preparing Historical Data

Sufficient historical data is essential for accurate backtesting and strategy optimization. Without this, the potential of the software and backtesting results will be limited, and we don’t want that.

Chart Preparation:

- Open desired trading pair chart.

- Select preferred time frame.

- Turn off auto scroll.

- Press and hold Home button on your keyboard.

- Wait for data to load to the earliest date while pressing on the Home button. Doing this action ensures all the historical data is loaded on the chart.

- Once done, re-enable auto scroll.

Pro Tip: Zoom out the chart for faster data loading.

BB Scanner Setup

Before starting, ensure the BB Scanner software has already been added and installed in your MT4 platform.

Initial Software Configuration:

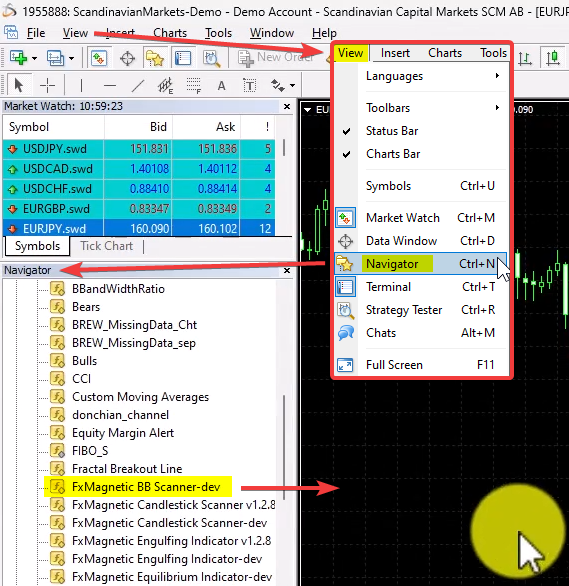

- Find BB Scanner in the Navigator window under Indicators in the MT4 platform.

- To access, click on View > Navigator.

- Double-click or drag to chart.

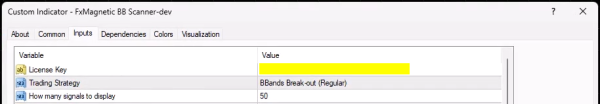

- Input license key.

- Initially, we suggest you start with BBands Break Regular strategy.

- Additionally, you can include a Simple Moving Average 200 as trade filter.

Building Your Trading Strategies

This software gives you the freedom to try hundreds of different settings. However, to get you started in the right direction, here is a sample setting you can try.

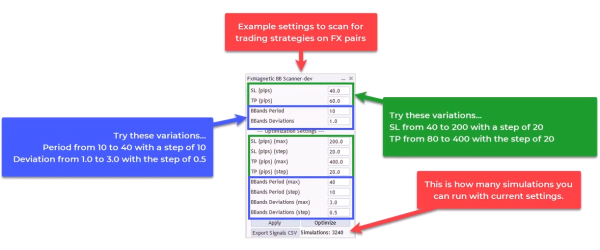

Set Parameter Ranges (JPY pairs, 1H time frame example):

- Stop Loss (SL) – from 40 to 200 with the step of 20.

- Example: 40, 60, 80, 100, etc. until it reaches 200.

- Take Profit (TP) – from 60 to 400 with the step of 20.

- Example: 60, 80, 100, 120, etc. until it reaches 400.

- BB Period – from 10 to 40 with the step of 10.

- Example: 10, 20, 30, and 40.

- BB Deviation – from 1.0 to 3.0 with the step of 0.5.

- Example: 1.0, 1.5, 2.0, 2.5, and 3.0.

You can see more sample settings in this cheat sheet. It’s important to understand that this is just the initial step and you are most likely to find better settings that are more profitable after you optimize.

Strategy Optimization

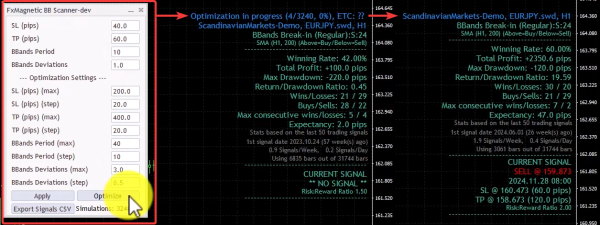

The optimization process tests thousands of combinations to find the most effective parameters for your strategy.

Preparation:

- Close unnecessary charts to improve processing speed. If possible, close other programs running on your computer too.

- Typical duration is 10 to 30 minutes depending on the computer’s power (hence closing other charts or programs).

- The software runs approximately 3,000 or more depending on your settings.

Review Results (Important!):

- Check win rate (Example: aim for 50% win rate or higher for strategies with

Risk/Reward of 2). - Evaluate total profit.

- Assess drawdown levels.

- Review return-to-drawdown ratio (I recommend aiming for 4 and higher).

- Examine trade frequency (example: 1.9 signals per week).

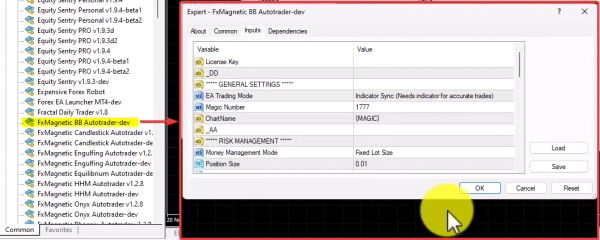

Auto Trader Configuration

Upon attaching to the chart, the BB Autotrader automates the BB Scanner indicator. Using it together ensures consistent execution without emotional interference.

Basic Setup:

- Locate BB Trader in Expert Advisors list under Navigator.

- Drag to the same chart where your BB scanner is attached.

- Input license key.

- Select indicator sync mode (recommended default).

- Manually set a unique magic number for strategy identification (example: 1777, 10, 125, etc.)

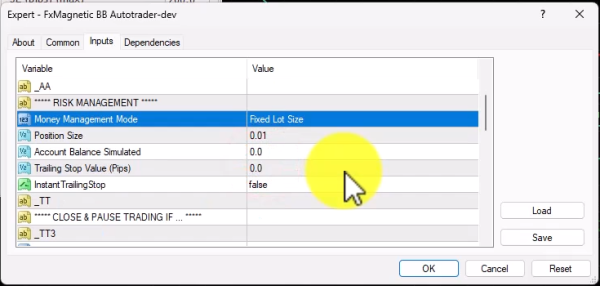

Risk Management Settings:

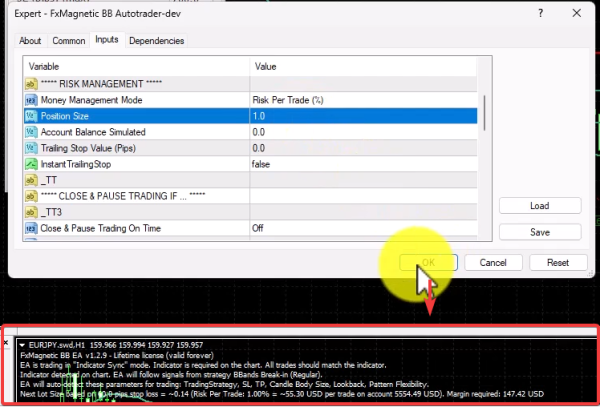

- For Money Management Mode, we suggest you choose Risk Per Trade (%).

- Set risk per trade (0.25% – 1% recommended). Once set, the software calculates the lot size automatically.

- Verify lot size and margin requirements displayed.

Verifying setup:

Once the setup is done, the auto-trader will print information on the top left corner of the chart.

It is important to understand that the speed of the output varies depending on the frequency of signals produced. Example: 5 minute time frame gives more signals faster but most of these signals are low quality. Unlike the 4 hour time frame which is slow yet gives better quality signals.

Strategy Monitoring

Proper monitoring ensures strategy effectiveness and helps identify when adjustments are needed.

Performance Metrics:

- Monitor consecutive wins/losses

- Track win rate percentage

- Review profit/loss ratios

- Evaluate drawdown levels

- Watch trade frequency

Strategy Validation:

- Allow minimum 20-30 trades for statistical significance.

- Monitor for three consecutive losses (Potential warning sign if strategy backtest showed 3 consecutive losses in the past).

- Track each strategy’s performance separately.

- Compare results against backtest expectations.

Strategy Portfolio Management

Building a robust trading portfolio requires careful strategy selection and monitoring.

Portfolio Development:

- Begin with 2-3 strategies.

- Add new strategies gradually.

- Diversify across different:

- Currency pairs

- time frames

- Trading instruments (forex, gold, indices)

Strategy Evaluation:

- Remove underperforming strategies.

- Keep successful strategies.

- Document performance metrics.

- Regular strategy review and optimization.

If you have tested one trading strategy and have a good grasp on how FxMagnetic BB Trader works, you can start exploring the other strategies here.

Tips For Success

- Higher time frames mean fewer but better trades – this is how real money is made in trading. The market wants you to overtrade on low time frames, but that’s often where traders lose. In short, quality vs. quantity.

- Be patient with results. Some strategies might need 5 days before you see your first trade. This is normal and prevents overtrading.

- Don’t immediately abandon your strategy when market behavior changes. Three consecutive losses is your signal to reevaluate or reoptimize.

- Never judge multiple strategies by overall account balance. A profitable strategy might be hidden by a losing one – track them separately.

- Think of strategies like a portfolio. When one isn’t performing well, others might cover for it. Start small, master a few strategies first, then gradually expand.

- A 100% win rate strategy does not exist. Keep this in mind so you can avoid over-optimizing. Aim for a strategy that has great stats where the win rate is high enough to be profitable.