In this tutorial, we will explore the three core trading strategies available in FX Magnetic BB Trader: Bollinger Bands Break-out, Bollinger Bands Break-in, and Bollinger Bands Break-out with Momentum. Each strategy comes with multiple variations which can help you take advantage of different market conditions and get better trading results in the process.

This guide will jumpstart your progress with FX Magnetic BB Trader so you can start utilizing its capabilities effectively.

Built-In Trading Strategies Quick Look

- Bollinger Bands Break-out

- Modes: Regular, Reverse, Buy Only, Sell Only.

- Bollinger Bands Break-in

- Modes: Regular, Reverse, Buy Only, Sell Only.

- Bollinger Bands Breakout with Momentum

- Modes: Regular, Reverse, Buy Only, Sell Only.

What Is the Bollinger Band?

Bollinger Bands are a volatility-based indicator consisting of three bands that expand and contract around price movement. Important things to understand:

- The bands consist of a middle line (20-period moving average) with upper and lower bands

- Upper and lower bands are set 2 standard deviations above and below the middle line

- Wider bands indicate increased market volatility

- Narrower bands suggest decreased volatility

- Price touching the bands often signals potential trading opportunities

- Band settings (period and deviation) can be customized based on trading strategy

Understanding The Scanner

The Scanner serves as the analytical engine, processing market data and generating signals based on your configured parameters.

It can operate independently without a visual indicator. Though optional, we suggest you add the built-in Metatrader Bollinger Band indicator.

Using both in tandem is a great way to visually verify the Scanner’s decision-making process.

The auto-trader that comes with the software is a great addition for when you find the parameters that work for you, and want to automate your trading.

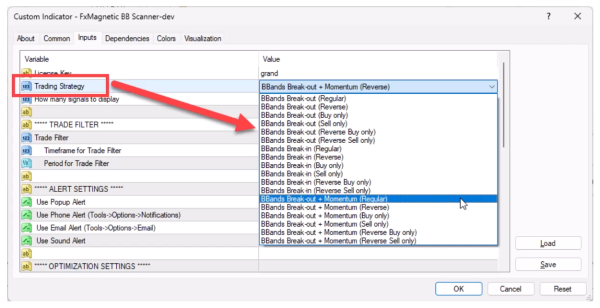

Scanner Configuration

The Scanner’s configuration panel presents several critical parameters that define your trading approach:

- Bollinger Band Period: Determines the lookback period for calculating trends.

- Deviations: Sets the upper and lower bands.

- Strategy Selection: Choose between Breakin, Breakout, or BBand Momentum approaches.

- Trade Direction: Regular, Reverse, or directional-only modes.

Each parameter can significantly impact your trading results, making proper configuration essential for optimal performance.

Trading Modes

Each strategy can be used in different modes:

Regular Mode

- Takes both buy and sell trades.

- Closes existing trades when an opposite signal appears.

- Only one trade opens at a time.

Reverse Mode

- Takes opposite trades from what the strategy indicates.

- Example: Take sell trade when strategy shows buy signal.

Buy Only Mode

- Only takes buy trades.

- Hold until stop loss or take profit.

- Ignores sell signals.

Sell Only Mode

- Only takes sell trades.

- Hold until stop loss or take profit.

- Ignores buy signals.

Reverse Buy Only Mode

- Only looks for buy signals but takes sell trades instead.

Reverse Sell Only Mode

- Only looks for sell signals but takes buy trades instead

Strategy Deep Dive

Each strategy can be executed in multiple modes to adapt to various market conditions:

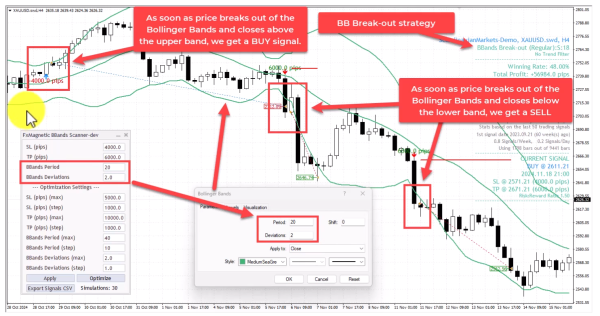

1. BB Break-Out Strategy (Regular Mode)

This strategy waits for price to enter the bands, hence called “break-in”.

The standard implementation follows traditional Bollinger Bands theory:

- The BB Scanner is set to use a Bollinger Bands period of 20 with deviation of 2.

- BUY signal is when the price breaks out of the Bollinger Bands and closes above the upper band.

- SELL signal is when the price breaks out of the Bollinger Bands and closes below the Lower band.

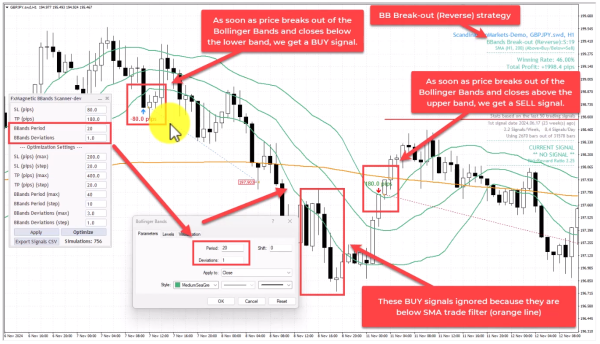

2. BB Break-Out Strategy (Reverse Mode)

This strategy waits for price to exit the bands, hence called “break-out”.

This contrarian approach inverts the traditional signals:

- The BB Scanner is set to use a Bollinger Bands period of 20 with deviation of 1.

- With an added 200-moving average serving as a buy and sell filter.

- BUY signal is when the price is above the 200-MA and breaks out of the Bollinger Bands and closes below the lower band.

- SELL signal is when the price is below 200-MA and breaks out of the Bollinger Bands and closes above the upper band.

3. BB Break-In Strategy (Regular Mode)

- The BB Scanner is set to use a Bollinger Bands period of 40 with deviation of 1.

- BUY signal is when the price breaks into the Bollinger Bands and closes above the lower band.

- SELL signal is when the price breaks into the Bollinger Bands and closes below the upper band.

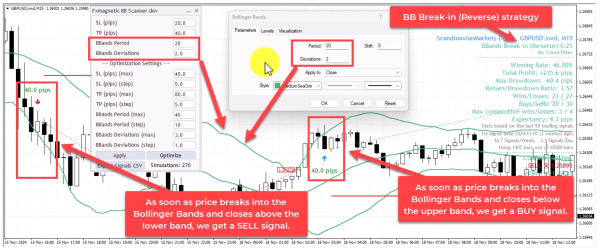

4. BB Break-In Strategy (Reverse Mode)

- The BB Scanner is set to use a Bollinger Bands period of 20 with deviation of 2.

- BUY signal is when the price breaks into the Bollinger Bands and closes below the upper band.

- SELL signal is when the price breaks into the Bollinger Bands and closes above the lower band.

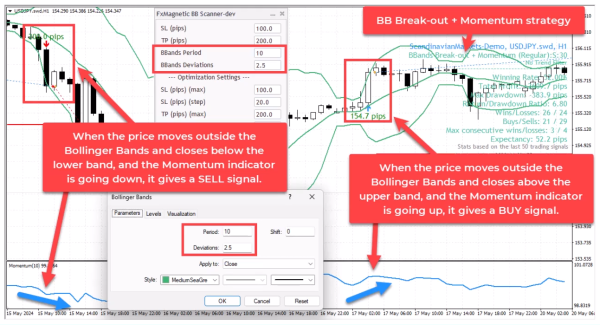

5. BB Break-Out Strategy + Momentum (Regular Mode)

- With an added momentum indicator to provide better trend strength signals.

- The BB Scanner is set to use a Bollinger Bands period of 10 with deviation of 2.5.

- BUY signal is when the price breaks out of the Bollinger Bands and closes above the upper band, and the Momentum indicator is going up.

- SELL signal is when the price breaks out of the Bollinger Bands and closes below the lower band, and the Momentum indicator is going down.

Note: If you attach the built-in MT4 momentum indicator, make sure the settings are the same.

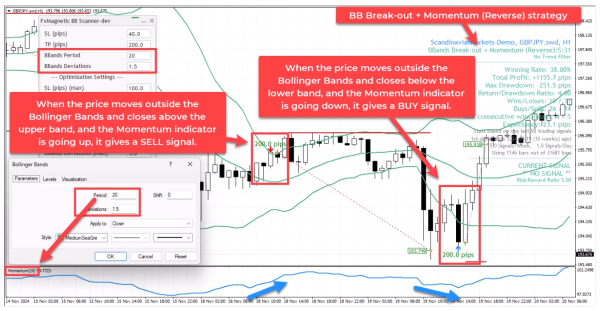

BB Break-Out Strategy + Momentum (Reverse Mode)

- With an added momentum indicator to provide better trend strength signals.

- The BB Scanner is set to use a Bollinger Bands period of 10 with deviation of 2.5.

- BUY signal is when the price breaks out of the Bollinger Bands and closes below the Lower band, and the Momentum indicator is going down.

- SELL signal is when the price breaks out of the Bollinger Bands and closes above the upper band, and the Momentum indicator is going up.

Important Trading Rules

- The software opens one trade at a time per strategy for better risk management. If you need more than one trade for some reason, or run different strategies at the same time, you can attach the software on another chart.

- NFor regular/reverse modes, new opposite signals close existing trades.

- For “only” modes, trades run until stop loss or take profit.

- You can use trend filters for additional confirmation.

- Consider reoptimizing the parameters or exploring other modes if experiencing more consecutive losses than historically normal.

Monitoring Performance

Track these key metrics:

- Win rate percentage

- Maximum consecutive losses

- Return to drawdown ratio

- Total pips/points gained

- Drawdown percentage

Understanding your numbers is crucial to your trading success. Remember, FxMagnetic can only help speed up your strategy development. Your outcomes would still depend on how well you use the software.

Tips for Success

- When starting out, we recommend you use the built-in Bollinger Band indicator from MT4 as visual confirmation for the scanner. Just remember to match the settings on both.

- Monitor max consecutive losses as indicator for the strategy viability.

- Consider monitoring the higher time frames to know the overall trend.

- Regularly optimizing the settings is a good practice to adapt to changes in market conditions.

- To better understand how the indicator and scanner work, we highly recommend you watch the tutorial.